Saving money quickly can often seem like an insurmountable task, but practical strategies make a significant difference. History has shown that small, consistent changes yield substantial results over time. For instance, setting a clear, specific savings goal can increase the likelihood of success by up to 77%.

The importance of tracking expenses cannot be overstated. By carefully monitoring your spending, you can identify unnecessary costs and make more informed financial decisions. Additionally, adopting simple habits such as cooking at home and canceling unused subscriptions can lead to significant, incremental savings.

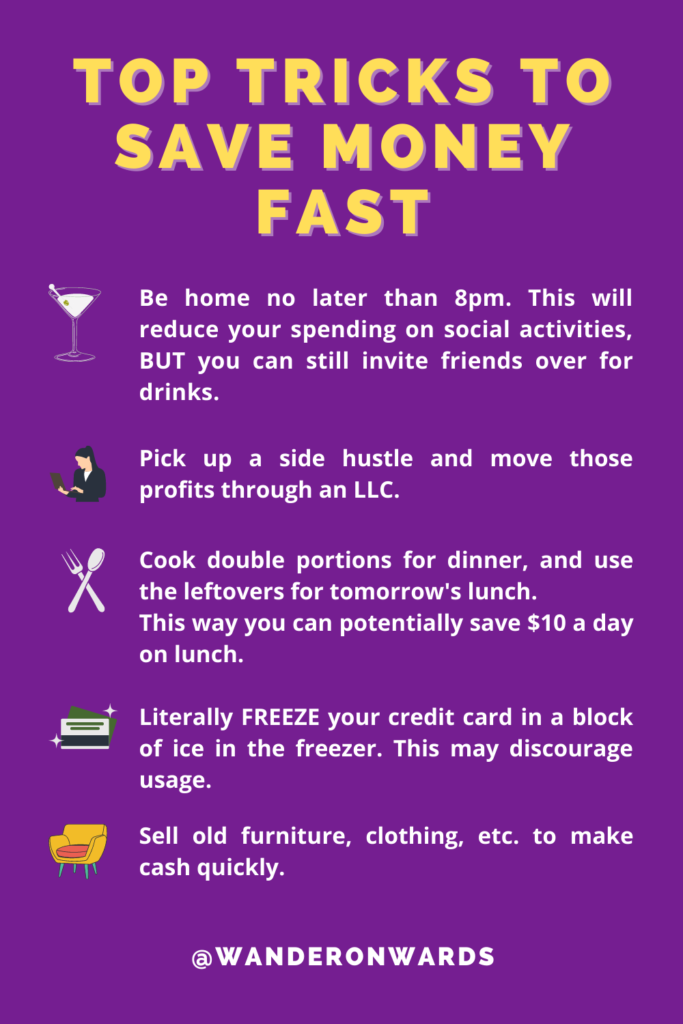

- Set a clear and specific savings goal.

- Create a budget to track your income and expenses.

- Cut non-essential spending like dining out or subscriptions.

- Automate your savings by setting up automatic transfers.

- Find ways to earn extra income, such as freelancing or side gigs.

Setting Financial Goals

Setting financial goals is the first step to gaining control over your money. Financial goals guide your spending and saving, helping you prioritize what matters most. Without financial goals, it’s easy to waste money on things that don’t matter.

Why Financial Goals Matter

Having clear financial goals gives you direction and purpose. It ensures that every penny you earn works towards something meaningful. Financial goals also motivate you to save and invest wisely.

By setting specific goals, like saving for a house or paying off debt, you have something concrete to aim for. This makes financial planning less overwhelming. Instead of vague aspirations, you know exactly what you need to do.

Another benefit is that goals can help you track your progress. Whether it’s a monthly savings target or a yearly investment plan, goals provide measurable milestones. This keeps you accountable and focused.

How to Set Financial Goals

Start by identifying your short-term and long-term objectives. Short-term goals might include saving for a vacation, while long-term ones could be buying a house. Write down these goals to make them official.

Next, set specific, measurable, achievable, relevant, and time-bound (SMART) targets. For example, instead of “save more,” aim for “save $500 per month for the next year.”

Review and adjust your goals as needed. Life changes, and so might your priorities. Regularly updating your goals ensures they remain realistic and attainable.

Tips for Achieving Financial Goals

Break down your big goals into smaller, manageable tasks. For example, if you’re aiming to save $6,000 in a year, plan to save $500 each month. This makes the goal less daunting.

Automate your savings to ensure consistency. Set up automatic transfers from your checking account to your savings or investment account. This reduces the temptation to spend.

Celebrate your progress along the way. Rewarding yourself for meeting milestones keeps you motivated and on track towards your ultimate goal.

Analyze Your Expenses

Understanding where your money goes is crucial for effective financial management. By analyzing your expenses, you can identify spending patterns and areas for improvement. This process helps you make informed decisions about your budget.

Identifying Key Expenses

Start by listing all your regular expenses, such as rent, utilities, and groceries. Divide them into categories like fixed and variable costs. This way, you can see which expenses are essential and which are flexible.

Review your bank statements and receipts to capture all your spending details. It’s easy to overlook small purchases, but they add up over time. Use this comprehensive list to understand your financial habits better.

Consider using charts or tables to visualize your spending patterns. This visual approach can make it easier to spot trends and areas where you can cut back.

Tracking Tools and Methods

Various tools can help you track your expenses efficiently. Smartphone apps like Mint or YNAB (You Need A Budget) offer user-friendly interfaces for recording and categorizing spending. These apps can also generate reports to show how your expenses change over time.

You can also use spreadsheets for a more customized approach. Create columns for different categories and regularly update them. This method allows for more flexibility and personalization.

Automating your tracking process can save time and reduce errors. Link your accounts to tracking tools so expenses are recorded automatically. This reduces the manual effort and ensures all spending is captured.

Benefits of Expense Analysis

Analyzing your expenses allows you to create a realistic budget. By knowing where your money goes, you can allocate funds more effectively. This helps prevent overspending and ensures you save for future goals.

It also helps you identify unnecessary or wasteful spending. By cutting out these expenses, you can redirect funds to more important areas. This leads to a healthier financial situation overall.

Additionally, regular analysis of expenses keeps you aware of your financial status. This awareness helps you stay disciplined and committed to your financial goals.

Prioritize Spending

Prioritizing your spending is essential for financial health. By focusing on necessary expenses, you can better manage your money and avoid overspending. Identify what is truly important and allocate your funds accordingly.

Start by making a list of your essential expenses, such as housing, utilities, and groceries. These are the costs you can’t avoid and should be your top priority. Ensure these needs are met before spending money on non-essentials.

Next, categorize your discretionary spending like dining out, entertainment, and hobbies. Determine what brings the most value to your life and cut back on less important areas. This approach helps you enjoy your money while still staying within your budget.

Regularly review and adjust your priorities as your financial situation changes. Life is dynamic, and so should be your budgeting. Stay flexible and always reassess to keep up with your evolving needs.

Techniques for Reducing Expenses

Reducing your expenses is a key step towards financial stability. One effective method is to create a budget and stick to it. A budget helps you track and control your spending.

Consider cutting down on utility bills. Simple actions like turning off lights when not in use and reducing water consumption can lower your monthly expenses. Switching to energy-efficient appliances also makes a big difference.

Eating out and ordering takeout can quickly drain your wallet. Plan your meals and cook at home instead. Preparing your own food is often cheaper and healthier.

Review your subscriptions and memberships. Cancel any that you don’t use or can live without. Services like streaming platforms, gym memberships, and magazine subscriptions can add up over time.

Shop smarter by looking for sales and using coupons. Compare prices before making a purchase to ensure you get the best deal. Buying in bulk for non-perishable items can also save you money in the long run.

Lastly, consider alternative modes of transportation. Walking, biking, or using public transport reduces fuel and maintenance costs. These options are also better for the environment.

Importance of Paying Debts on Time

Paying your debts on time is crucial for maintaining a healthy financial life. Timely payments prevent late fees and interest charges, saving you money. This habit keeps you from falling into deeper debt.

On-time payments positively impact your credit score. A good credit score opens doors to better financial opportunities, like lower interest rates on loans. It also affects your chances of getting approved for credit in the future.

Paying off debts promptly reduces stress and anxiety. Knowing that you’re managing your obligations well gives you peace of mind. This sense of control can improve your overall well-being.

Consistent repayments show that you are responsible with your finances. This reliability can benefit you if you need to borrow money again. Lenders appreciate borrowers who have proven their ability to repay on time.

Falling behind on payments can lead to severe consequences. You may face collection actions, wage garnishments, or even legal troubles. Avoid these issues by staying current with your debt repayments.

Building an Emergency Fund

Building an emergency fund is essential for financial security. An emergency fund acts as a safety net for unexpected expenses like medical bills or car repairs. It ensures you don’t have to rely on credit cards or loans.

Start by setting a monthly savings goal. Consistently saving small amounts can build up over time. Even saving $50 a month adds up to $600 a year.

Consider keeping your emergency fund in a separate, easily accessible account. This can reduce the temptation to dip into it for non-emergencies. A high-yield savings account could also earn you interest over time.

Aim to save enough to cover three to six months’ worth of living expenses. This may seem daunting, but focus on gradual progress. Each contribution brings you closer to financial resilience.

Regularly review and adjust your savings plans. Life circumstances change, and your emergency fund should reflect that. Consistent monitoring ensures your fund remains adequate for potential emergencies.

Make Additional Income Streaming

Streaming can be a lucrative way to earn extra income. Platforms like Twitch and YouTube offer opportunities for content creators to make money. Many people turn their hobbies into profit through streaming.

You need basic equipment such as a good camera, microphone, and stable internet connection. Invest in quality tools for a better viewing experience. This can attract more viewers and potential subscribers.

Engage your audience by interacting with them during streams. Respond to their comments and questions to build a loyal community. A dedicated fan base can significantly boost your earning potential.

Monetize your streams through ads, donations, or subscriptions. Many platforms allow viewers to support their favorite creators financially. Consider offering exclusive content for those who subscribe.

Collaborate with other streamers to grow your audience. Joint streams introduce you to new viewers who may become regulars on your channel. Networking is key in expanding your reach.

Lastly, promote your streams on social media platforms. Use Twitter, Instagram, and Facebook to alert followers about upcoming broadcasts. This boosts visibility and draws in more viewers.

Cultivating a Savings Mindset

Cultivating a savings mindset is essential for achieving your financial goals. Changing how you think about money can lead to smarter spending and increased savings. It starts with making savings a priority in your life.

First, set clear and achievable savings goals. Break them down into smaller, manageable tasks. This makes the process less overwhelming and keeps you motivated.

Next, adopt the habit of paying yourself first. Set aside a portion of your income for savings before allocating money for other expenses. This ensures you always contribute to your savings fund.

Track your spending to understand your financial habits. Use tools like budgeting apps or spreadsheets to monitor where your money goes. This helps you identify areas where you can cut back and save more.

Learn to differentiate between needs and wants. Focus on fulfilling essential needs first, and limit spending on non-essential items. Practicing delayed gratification can also help you save for bigger financial goals.

Lastly, surround yourself with like-minded individuals who support your financial journey. They can provide motivation and share useful tips. A strong support system makes it easier to stay committed to your savings goals.

Frequently Asked Questions

Saving money quickly can be a challenging task, but with the right strategies, it becomes achievable. Here are some common questions and answers that address various aspects of saving money fast.

1. How can I cut down on my monthly expenses effectively?

You can start by reviewing all your monthly subscriptions and memberships. Cancel any services you don’t use regularly. Next, consider reducing utility bills by being more energy-efficient at home.

Additionally, plan your meals and cook at home to save on dining costs. Buying in bulk and using coupons can also lower grocery bills significantly. These small changes add up over time.

2. What are some quick ways to earn extra income?

Freelancing is an excellent way to make extra money using your skills. Platforms like Upwork or Fiverr offer opportunities for various freelance work, from writing to graphic design.

You might also consider part-time jobs or side gigs like dog walking or tutoring. Selling unused items online through sites like eBay or Craigslist can provide instant cash as well.

3. Should I prioritize paying off debt or saving money?

This depends on the interest rates of your debts versus the potential gains from savings or investments. Typically, it’s wise to pay off high-interest debt first because it accumulates faster than low-interest debt.

Savings are still essential for emergencies, so aim for a balance between paying off debt and saving money simultaneously. An emergency fund prevents you from incurring more debt during unexpected situations.

4. How does tracking expenses help save money?

Tracking expenses lets you see where your money goes each month. Identifying spending patterns makes it easier to adjust your budget and cut out unnecessary costs.

You can use apps like Mint or YNAB (You Need A Budget) for efficient tracking. This practice helps you stay accountable and disciplined with your finances.

5.ColumnName: What role does mindset play in financial success?

- Description:

- A positive mindset encourages consistent savings behavior.

- The It helps differentiate needs from wants

.Setting specific goals keeps you

• motivated.,and,

It aids in avoiding impulse spends by focusingmoney is essentialembangkan Financial security requires long-terminvesting Habits should be practicedforuccess A strong support network encourages discipline protects against setbacks.

· Your spending action reflects attitude impact so develop healthy habits early financial decisions.features naturally leading strategies implementation encourage real-world results achieved practical sustainable manner.

Conclusion

Mastering the art of saving money quickly requires a strategic approach and dedication. By setting clear financial goals, tracking expenses, and prioritizing spending, you can create a robust financial plan. Implementing these techniques will pave the way for financial security.

Additionally, building an emergency fund and exploring extra income streams are essential steps. Cultivating a savings mindset ensures long-term success. With discipline and commitment, achieving your financial objectives becomes not just possible, but inevitable.