When a subreddit community can turn a struggling company into a market sensation, the financial world can’t help but take notice. The saga of meme stocks, such as GameStop and AMC, has been nothing short of extraordinary. These stocks, propelled by online forums and fueled by collective action, disrupted traditional market dynamics in unexpected ways.

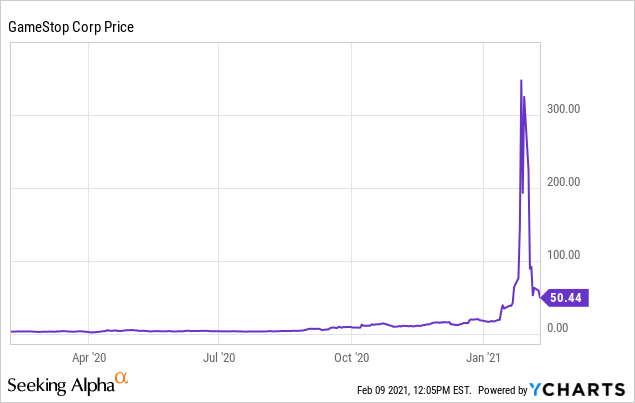

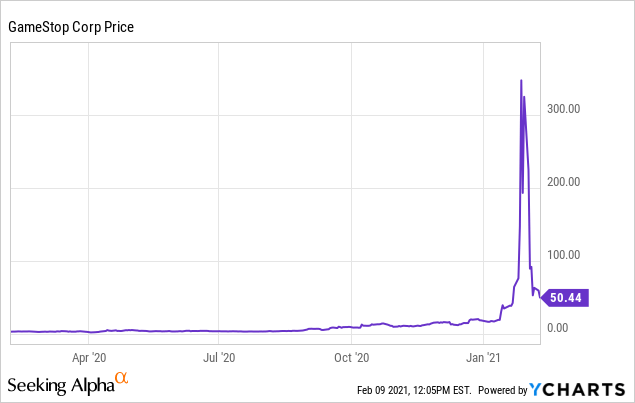

Historically, the concept of valuation and intrinsics guided stock market decisions. However, meme stocks flipped the script in 2021 when GameStop’s shares soared over 1,700% in just a few weeks. This meteoric rise wasn’t based on fundamentals but on the sheer will of enthusiastic retail investors banding together on platforms like Reddit’s r/WallStreetBets.

The Phenomenon of Meme Stocks: An Overview

Meme stocks have turned the traditional stock market on its head. These are stocks that gain massive popularity through social media and online forums. Instead of relying on fundamentals, they are driven by viral trends and collective enthusiasm.

The concept of meme stocks started gaining attention with GameStop in 2021. Retail investors banded together, using platforms like Reddit’s r/WallStreetBets. Their collective buying power caused stock prices to surge.

Social media plays a crucial role in the rise of meme stocks. Platforms like Twitter and TikTok allow ideas to spread quickly. This creates a snowball effect, driving more people to invest.

Meme stocks challenge traditional investment strategies. They show that market sentiment can sometimes outweigh financial fundamentals. This phenomenon is reshaping how many view investing.

GameStop: The Genesis of Meme Stocks

GameStop’s rise is the epitome of the meme stock phenomenon. It all began when retail investors on Reddit’s r/WallStreetBets identified GameStop as an opportunity. What followed was an unprecedented surge in the stock’s price.

Roots of the GameStop Surge

The financial troubles of GameStop, a video game retail chain, were well-known. Hedge funds had heavily shorted its stock, betting against the company’s success. Retail investors saw this as a chance to challenge these big players.

By banding together, small investors could create a short squeeze. This caused stock prices to rise, forcing short sellers to buy back shares at higher prices. The collective action resulted in massive financial gains for many small investors.

The media quickly picked up on this story. Suddenly, GameStop was a household name. Social media amplified the movement, attracting even more attention.

The Role of Online Communities

Social media forums played a crucial role in organizing the surge. Platforms like Reddit and Twitter became the rallying point. Communication in these spaces was fast, direct, and passionate.

These online communities shared tips, strategies, and buy signals. The sense of camaraderie fueled the movement. It was no longer just about money but also about making a statement.

This collaboration showcased the power of collective online action in financial markets. The speed and scale of the movement caught traditional financial institutions off guard.

How GameStop Redefined Investing

GameStop’s surge redefined how we think about investing. It showed that sentiment, not just fundamentals, can drive stock prices. This event broke many conventional investing rules.

Seasoned investors watched in disbelief as GameStop’s stock rocketed. New investors gained confidence from this successful challenge to established norms. The event highlighted the potential and risks of collective action.

GameStop’s story is far from typical. But it serves as a powerful example of the influence of digital communities on financial markets.

AMC Entertainment: Another Meme Stock Winner

AMC Entertainment became another unexpected star in the meme stock saga. This theater chain was struggling due to the pandemic. However, retail investors saw potential and rallied behind it.

Just like with GameStop, platforms like Reddit’s r/WallStreetBets played a key role. Investors organized a buying frenzy, causing AMC’s stock prices to climb. This collective effort boosted AMC’s market value.

During AMC’s rise, many small investors profited significantly. They bought low and sold high, capitalizing on the surge. The buzz around AMC created a domino effect, pulling in more investors.

This event showed the power of retail investors once again. By backing AMC, they saved a company many had counted out. It was a victory for the little guy in the financial world.

The Role of Retail Investors in Meme Stocks

Retail investors have become key players in the meme stock phenomenon. Unlike institutional investors, they are everyday people trading stocks using online platforms. Their collective actions can significantly influence stock prices.

Social media has given retail investors a powerful voice. Platforms like Reddit, Twitter, and TikTok allow them to share insights and strategies quickly. This rapid communication can lead to coordinated buying sprees.

One significant advantage retail investors have is their sheer number. When they unite behind a stock, they can create a massive impact. This was evident in the cases of GameStop and AMC.

However, there are also risks involved. Retail investors may not have the same level of financial knowledge as professionals. This lack of experience can lead to poor investment decisions.

Despite these risks, the success stories have inspired more people to participate. Platforms like Robinhood have made it easier than ever to start trading. This democratization of investing has reshaped the financial landscape.

Retail investors have proven they can challenge traditional market players. Their influence shows that investing isn’t just for the wealthy. With the power of the internet, everyone can have a chance at success.

Successful Meme Stocks vs Traditional Investments

Meme stocks and traditional investments often yield very different results. Meme stocks can provide quick, high returns but also come with high risks. In contrast, traditional investments usually offer slower, steadier growth.

Let’s compare their characteristics:

| Aspect | Meme Stocks | Traditional Investments |

|---|---|---|

| Risk Level | High | Moderate to Low |

| Return Speed | Fast | Slow |

| Market Influence | Social Media | Economic Indicators |

Meme stocks thrive on social media buzz. When a stock gets popular online, its price can skyrocket quickly. But, if the buzz dies down, so can the stock’s value.

Traditional investments, like blue-chip stocks, rely on economic indicators. These investments are often in well-established companies with a long history of stable returns. They are considered safer and more reliable in the long run.

The success of meme stocks can tempt many to dive in quickly. But it’s essential to remember that high rewards come with high risks. Traditional investments might not be as exciting, but they offer a sense of security.

Both investment types have their place in a diversified portfolio. Balancing meme stocks with traditional investments might give investors a mix of quick gains and long-term stability. It’s all about finding the right balance for your financial goals.

The Impact of Meme Stocks on Financial Markets

Meme stocks have shaken up the traditional financial markets. Retail investors have shown their power to disrupt conventional trading norms. This has forced institutional investors to reevaluate their strategies.

The rapid price movements in meme stocks create a volatility ripple effect. This affects not just the specific stock but the entire market. Sudden surges or drops can cause widespread market turbulence.

Meme stocks have also captured the attention of regulators. Concerns about market manipulation and ethical trading practices are rising. As a result, financial bodies are considering new regulations to manage this trend.

Let’s look at some key impacts:

| Impact Area | Meme Stocks Effect |

|---|---|

| Market Volatility | Increased |

| Investment Strategies | Shifted |

| Regulations | Under review |

The rise of meme stocks has also democratized the stock market. More people are participating in the market than ever before. This broader inclusion challenges the dominance of big institutional investors.

While meme stocks bring excitement, they also come with risks. Unpredictable price swings can lead to significant losses. Investors must navigate carefully to take advantage of these opportunities.

Future of Meme Stocks: A Passing Fad or a New Trend?

The future of meme stocks is a hot topic among investors. Some think they are just a passing fad, while others believe they represent a new trend. Both sides have compelling arguments.

Those who see meme stocks as temporary point to their unstable nature. Stock prices can shoot up and plummet quickly, causing unpredictable losses. This instability makes them seem like a short-lived phenomenon.

On the other hand, supporters argue that meme stocks are here to stay. The power of social media to influence markets isn’t going away. As long as online communities exist, these kinds of stock movements could continue.

Let’s examine some factors:

| Factor | Implication |

|---|---|

| Social Media Presence | Sustains Popularity |

| Market Volatility | Adds Risk |

| Younger Investors’ Involvement | Makes It Last Longer |

Younger investors play a significant role in the longevity of meme stocks. Their comfort with technology and social media drives this trend. As more young people enter the market, this way of investing may become more normalized.

The regulatory landscape will also affect the future of meme stocks. If strict rules are put in place, it could deter some from participating. However, sensible regulations might make this investment space safer and more sustainable.

No one can predict the future for sure. But with ongoing interest from retail investors and support from social platforms, meme stocks might remain a significant part of the market landscape. The key question is how adaptable they will be in changing conditions.

Lessons Learned from the Meme Stock Movement

The meme stock movement has taught us several crucial lessons. One of the biggest takeaways is the power of collective action. When retail investors band together, they can significantly influence the market.

Another lesson is the importance of social media. Platforms like Reddit and Twitter can drive investment decisions. With information spreading rapidly, stocks can experience dramatic changes in short periods.

Transparency is also crucial. Retail investors should understand the risks involved. High rewards often come with high risks, and it’s essential to be aware of both.

Let’s summarize the key lessons:

- Collective Action: Retail investors can impact the market.

- Social Media Influence: Information spreads quickly, affecting stock prices.

- Risk Awareness: High returns come with high risks.

- Regulations: Proper guidelines can ensure safer trading environments.

The meme stock movement also underscored the need for better financial education. Understanding stock market basics can save investors from potential pitfalls. Knowledge empowers investors to make informed decisions.

Finally, regulation has a role to play. Governing bodies need to set rules that protect investors while allowing the market to function efficiently. Balanced regulations can create a safer trading environment for everyone.

Frequently Asked Questions

Meme stocks have gained significant attention in the financial markets. Here are some common questions and answers to help you understand this phenomenon better.

1. What is a meme stock?

A meme stock is a company’s shares that gain popularity through social media and online forums rather than their fundamentals. These stocks often see rapid price increases due to viral trends and coordinated buying among retail investors.

This trend started with stocks like GameStop, driven by discussions on Reddit’s r/WallStreetBets. People collectively bought these stocks, creating a significant market impact and defying traditional investment expectations.

2. How did the GameStop surge begin?

The GameStop surge began when retail investors noticed that hedge funds had heavily shorted the stock. This led them to collectively buy shares, creating a short squeeze that caused dramatic price hikes.

Social media amplified this movement, inviting more participants and increasing the stock’s value remarkably fast. As more people joined the cause, it created an unexpected but massive market event.

3. Why do retail investors favor meme stocks?

Retail investors favor meme stocks because they offer the potential for quick gains through collective action. Social media platforms make organizing such movements easy and effective.

Another reason is the excitement of challenging institutional investors and making significant returns from small investments. It’s both a financial opportunity and a community-driven activity.

4. What risks are associated with investing in meme stocks?

Investing in meme stocks comes with high risks due to their volatile nature. Prices can fluctuate dramatically within short periods, leading to potential losses as quickly as gains.

An additional risk is the lack of underlying financial strength in many of these companies, making their long-term viability uncertain. Investors must proceed cautiously and be prepared for sudden changes in fortune.

5. Can regulatory changes affect meme stocks?

Yes, regulatory changes can significantly impact meme stocks by introducing rules to curb market manipulation and protect investors. Regulatory bodies are closely examining such activities to ensure ethical trading practices are maintained.

If stricter regulations are implemented, it could reduce extreme volatility but might also limit the free actions of retail investors on social media platforms. The balance between protection and freedom will be crucial moving forward.

Conclusion

The rise of meme stocks is a testament to the power of collective action in the digital age. Investors, armed with social media, have shown they can challenge traditional market forces. This movement has reshaped our understanding of stock trading.

While exciting and potentially lucrative, meme stocks come with high risks and significant volatility. Balancing these investments with traditionally stable assets can provide a more secure approach. Whether a fleeting trend or a lasting shift, meme stocks have undoubtedly left their mark on the financial landscape.