Ever wondered why even seasoned investors might lose millions in a market crash while others stay afloat? This discrepancy often boils down to one crucial strategy: diversification. Balancing your assets across various classes can significantly reduce risk and improve your chances of stable returns.

The roots of portfolio diversification can be traced back to Harry Markowitz’s Modern Portfolio Theory in the 1950s. Studies show that diversified portfolios can achieve similar returns with about 30% less volatility compared to non-diversified ones. By spreading investments across different sectors, geographic regions, and asset types, investors can mitigate the impacts of individual market downturns.

The Art of Diversifying Your Investments

Creating a diversified investment portfolio is like building a solid and balanced team. Just as a sports team needs players with different skills, your portfolio needs various asset classes. This helps in spreading risk and increasing potential returns.

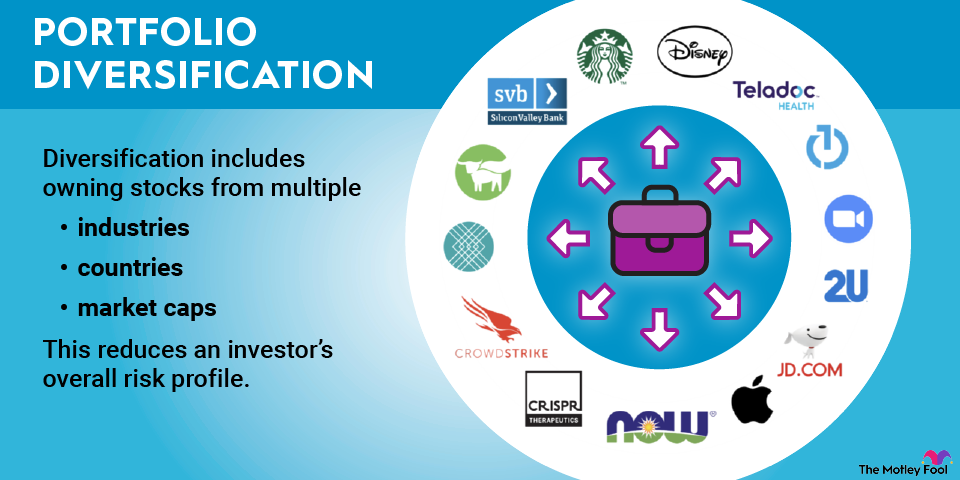

Diversifying investments means mixing different types of assets. This could include stocks, bonds, real estate, and even commodities like gold. These varied investments react differently to market changes, providing a safety net.

One key aspect of diversification is not putting all your money in one type of asset. If one investment drops in value, others might still perform well. For example, while stocks might fall, bonds could rise, balancing your losses.

To achieve true diversification, it’s also essential to consider geographic diversification. Investing in both domestic and international markets can help reduce risk. If one country’s economy struggles, investments in another country might still thrive.

Importance of Investment Diversification

Investment diversification is crucial because it minimizes risk. Instead of relying on a single type of investment, which can be risky, spreading investments across various assets decreases the impact of market fluctuations. This leads to more stable returns over time.

Historically, diversified portfolios have shown lower volatility compared to concentrated ones. When one asset type performs poorly, another often compensates for it. This balance helps maintain overall growth and protect against significant losses.

Diversification isn’t just about asset classes; it’s about sectors too. Investing in different industries helps avoid being heavily affected by downturns in any one sector. This strategic approach strengthens the safety of your investments.

Roots of Portfolio Diversification: Modern Portfolio Theory

The concept of diversification gained prominence through Harry Markowitz’s Modern Portfolio Theory (MPT) introduced in the 1950s. MPT suggests that a diversified portfolio can provide the highest expected return for a given level of risk. Markowitz’s theory revolutionized investment strategies.

MPT is based on the idea that different assets often do not move together. By investing in a mix of assets, the portfolio’s overall risk can be reduced. This concept is illustrated through the efficient frontier, a graph showing optimal portfolios.

Modern Portfolio Theory remains a cornerstone in financial planning. It emphasizes the importance of balancing risk and reward in an investment strategy. Investors continue to use these principles to build more resilient portfolios.

Importance of Investment Diversification

Diversifying your investments is vital because it helps spread risk. Instead of relying on one investment, you benefit from different asset classes. This approach makes your portfolio more stable over time.

Combining assets that don’t move in the same direction reduces volatility. For example, if stocks drop, bonds might stay steady or rise. This balance helps protect your investments from big losses.

Diversification also means investing in various sectors. By putting money in different industries, you avoid being heavily impacted by any one sector’s downturn. This strategy strengthens your portfolio’s resilience.

Geographic diversification is another key aspect. Investing in both domestic and international markets can help mitigate risks specific to one country. This way, your investments can stay secure even if one market struggles.

Benefits of Diversifying Investments

When you diversify, you reduce your portfolio’s exposure to risk. It’s like not putting all your eggs in one basket. This strategy protects you if one investment performs poorly.

Historically, diversified portfolios have shown more stable returns. Market fluctuations affect different assets in various ways. By diversifying, you capture growth from multiple sources.

. For example, if the tech industry suffers, investments in healthcare might perform well. This balance helps maintain your overall financial health.

Key Principles of Portfolio Diversification

One principle is to mix asset types like stocks, bonds, and real estate. Each asset class responds differently to market changes. This mix helps in smoothing out volatility.

Another principle is sector diversification. Investing in various industries like technology, healthcare, and energy reduces the impact of a downturn in any one sector. This strategy keeps your portfolio robust.

Geographic diversification is essential too. By investing in both local and international markets, you spread your risk. This approach protects your investments from economic issues in a single country.

Common Mistakes in Diversification

One mistake is over-concentrating in one asset class. This approach increases your risk if that asset performs poorly. A well-balanced portfolio avoids this pitfall.

Another mistake is neglecting ongoing portfolio management. Diversification is not a one-time task. Regularly rebalancing your portfolio ensures it remains aligned with your investment goals.

Sometimes, investors forget about geographic and sector diversification. Focusing too much on one market or industry can be risky. A global and multi-sector approach offers better protection.

Roots of Portfolio Diversification: Modern Portfolio Theory

The concept of diversification became popular thanks to Harry Markowitz. In the 1950s, he introduced the Modern Portfolio Theory (MPT). MPT revolutionized the way investors approach building a portfolio.

Modern Portfolio Theory focuses on optimizing a portfolio by balancing risk and return. It suggests that by diversifying investments, you can achieve better overall performance. MPT uses mathematical models to determine the best asset mix.

At the heart of MPT is the idea of the efficient frontier. The efficient frontier represents a set of optimal portfolios that offer the highest expected return for a given level of risk. This helps investors choose the right mix of assets to achieve their financial goals.

Despite being decades old, Modern Portfolio Theory remains relevant. Investors still use it to design diversified portfolios that withstand market volatility. It serves as a foundational concept in financial planning and investment strategies.

Designing the Diversified Investment Portfolio

Creating a diversified investment portfolio requires careful planning. Start by identifying your financial goals and risk tolerance. This helps you decide how much to invest in different asset classes.

Asset classes typically include stocks, bonds, real estate, and cash. Each asset class responds differently to market changes. Balancing these can help manage risks effectively.

Next, consider geographic diversification. Investing in both domestic and international markets can reduce risk. Global exposure helps in capturing growth from various economies.

Regular rebalancing is crucial to maintain your portfolio’s diversity. Over time, some investments may grow faster than others. Adjusting your portfolio keeps it aligned with your initial goals.

Here’s a simple example of diversified asset allocation:

| Asset Class | Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Real Estate | 10% |

| Cash | 10% |

Diversification also involves sector allocation. Investing in various industries, like tech, healthcare, and energy, helps spread risk. This strategy ensures your portfolio isn’t dependent on a single sector’s performance.

Deciding the Right Asset Allocation

Choosing the right asset allocation depends on your financial goals and risk tolerance. Consider your age and investment horizon. Younger investors often have time to recover from market dips, allowing for more aggressive strategies.

Bonds provide stability and regular income. Stocks offer growth potential but can be volatile. Real estate is another asset class that can provide both income and appreciation.

Here’s a basic asset allocation based on different risk profiles:

| Risk Profile | Stocks | Bonds | Real Estate | Cash |

|---|---|---|---|---|

| Conservative | 30% | 50% | 10% | 10% |

| Moderate | 50% | 30% | 10% | 10% |

| Aggressive | 70% | 20% | 5% | 5% |

Geographic allocation is also vital. Diversifying investments across different regions can protect against localized economic downturns. Emerging markets might offer higher growth but come with higher risks.

It’s essential to reassess your asset allocation periodically. Life events and market conditions can change your risk tolerance and investment goals. Rebalancing keeps your portfolio aligned with your objectives.

Balancing Domestic and International Investments

Incorporating both domestic and international investments adds a layer of diversification to your portfolio. Each market has unique opportunities and risks. Spreading investments globally can enhance growth and reduce risk.

Domestic investments often feel safer due to familiarity with local economies and regulations. They provide stability and might be easier to monitor. However, they can be susceptible to local economic downturns.

International investments offer exposure to various economic conditions. While they bring growth potential, they also come with risks like currency fluctuations and geopolitical issues. Diversifying globally helps in balancing these risks.

Here’s a simple breakdown of a balanced portfolio:

| Investment Type | Allocation |

|---|---|

| Domestic Stocks | 40% |

| International Stocks | 30% |

| Domestic Bonds | 20% |

| International Bonds | 10% |

Rebalancing your portfolio is essential to maintain the right mix of investments. Market fluctuations can shift your asset allocation over time. Regularly reviewing and adjusting your portfolio keeps it aligned with your goals.

Consider seeking professional advice when balancing domestic and international investments. Financial experts can provide valuable insights into global markets. They can help create a strategy tailored to your risk tolerance and investment goals.

Keeping Your Investment Portfolio Diverse

Maintaining a diverse investment portfolio involves regularly monitoring and adjusting your assets. Market conditions change, and so should your investments. Periodic rebalancing ensures your portfolio stays aligned with your goals.

One way to keep diversity is to choose assets from various industries. For example, split investments among tech, healthcare, and energy sectors. This strategy reduces the risk of decline in one particular industry.

Diversifying asset types is equally crucial. Include stocks, bonds, real estate, and even commodities in your mix. This variety helps cushion against market volatility.

The following table shows a diverse asset allocation:

| Asset Class | Allocation |

|---|---|

| Stocks | 40% |

| Bonds | 30% |

| Real Estate | 20% |

| Commodities | 10% |

Diverse geographic allocation also benefits long-term stability. Investing in both domestic and international markets spreads economic risks across borders. This approach opens doors to growth opportunities in different economies.

You might also consider mutual funds or ETFs (Exchange-Traded Funds). They simplify diversification by offering a range of assets within one fund. These options can streamline the process while maintaining exposure to multiple markets.

Rebalancing the Portfolio

Rebalancing your portfolio is crucial for maintaining your desired asset allocation. Over time, some investments grow faster than others. This can skew your original asset mix and increase risk.

Periodic reviews are essential to rebalance effectively. Set a schedule, such as quarterly or annually, to check your portfolio. This helps you stay on track with your financial goals.

Rebalancing involves selling overperforming assets and buying underperforming ones. This might seem counterintuitive but it helps in maintaining balance. You ensure your portfolio aligns with your risk tolerance.

Here’s a simple example of rebalancing:

| Asset Class | Original Allocation | New Allocation |

|---|---|---|

| Stocks | 50% | 60% |

| Bonds | 30% | 25% |

| Real Estate | 10% | 8% |

| Cash | 10% | 7% |

After rebalancing, the allocations should return to:

| Asset Class | Target Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Real Estate | 10% |

| Cash | 10% |

Automated rebalancing tools can simplify this process. Many financial services offer automated solutions that help keep your portfolio balanced without constant monitoring. This can be particularly helpful for busy investors.

Case Studies of Diversified Investment Portfolios

Case studies help us understand the real-world benefits of diversification. Let’s look at two examples. These showcase how diversification can protect and grow investments.

Our first case study is an investor with a blend of stocks, bonds, and real estate. During a market downturn, the value of their stocks plummeted. However, their bonds and real estate holdings remained stable, cushioning the overall loss.

The second case features a portfolio with domestic and international stocks. When the local economy showed slow growth, global investments picked up the slack. This balance ensured steady returns despite local challenges.

Here’s a summary of these case studies:

| Case Study | Assets | Outcome |

|---|---|---|

| 1 | Stocks, Bonds, Real Estate | Protected from Market Downturn |

| 2 | Domestic and International Stocks | Steady Returns Amid Local Slowdown |

Lessons from these case studies include maintaining a mix of asset classes and geographic diversification. This helps balance risk and reward. Diversification remains a key strategy for long-term investment success.

These real-world examples demonstrate how a diversified portfolio can weather various market conditions. Investors should aim for a well-rounded mix to achieve financial stability and growth. Case studies like these provide valuable insights for planning your own investment strategy.

Frequently Asked Questions

Creating a diversified investment portfolio can seem complex, but it doesn’t have to be. Below are frequently asked questions to help you understand the basics more clearly.

1. How does diversification reduce investment risk?

Diversification reduces investment risk by spreading your money across various asset classes such as stocks, bonds, and real estate. When one type of asset performs poorly, others might perform well, balancing out the overall impact on your portfolio.

This strategy helps manage volatility and provides more stable returns over time. By not putting all your eggs in one basket, you minimize the chance of significant losses affecting your entire investment.

2. What is the role of asset allocation in portfolio management?

Asset allocation is key in portfolio management because it determines how your investments are distributed among different asset categories like stocks, bonds, and cash. This distribution helps achieve the right balance between risk and return according to your financial goals.

A well-thought-out asset allocation plan can increase the likelihood of meeting your targets while managing risks effectively. It allows for adjustments based on market conditions and personal financial changes.

3. Should I include international investments in my portfolio?

Yes, including international investments can add another layer of diversification to your portfolio. Different markets around the world often don’t move in synchronicity, which can help smooth out volatility.

Investing globally exposes you to growth opportunities from emerging economies and developed markets alike. This broader exposure can help mitigate risks specific to any single country or region.

4. How often should I rebalance my diversified portfolio?

You should typically rebalance your diversified portfolio either quarterly or annually to maintain its desired level of risk and return. Rebalancing involves adjusting allocations back to their target percentages after market fluctuations cause them to drift.

This regular adjustment ensures that no single investment becomes too dominant within your portfolio. Automated tools are also available to simplify this process if manual tracking proves burdensome.

5. Can mutual funds or ETFs help with diversification?

Absolutely! Mutual funds and ETFs (Exchange-Traded Funds) offer a simple way to diversify by pooling investments across a broad range of assets or sectors within one fund. This makes achieving diversification easier without buying individual securities separately.

These pooled funds are managed by professionals who adjust holdings based on market conditions and performance goals, offering an efficient way for investors to achieve balanced portfolios with less effort.

Ray Dalio’s All Weather Portfolio: How To Properly Diversify Your Investments And Lower RiskConclusion

Building a diversified investment portfolio is essential for managing risk and securing stable returns. By strategically allocating your assets among stocks, bonds, real estate, and international investments, you create a more resilient financial plan. Rebalancing and continuous monitoring ensure your portfolio stays aligned with your goals.

Whether you’re an experienced investor or just starting, the principles of diversification can significantly enhance your investment strategy. Utilize tools like mutual funds and ETFs to simplify the process. Ultimately, a well-diversified portfolio can offer peace of mind and long-term financial growth.