Key takeaways

- There’s more than one way to pay off an Apple Card, including online payments or recurring and one-time payments.

- Officially, the Apple Card doesn’t allow for balance transfers to the card, and it doesn’t appear to let consumers transfer their Apple Card balances to other balance transfer cards either.

- It may be possible to complete a balance transfer, but be prepared for the possibility of extra fees or Goldman Sachs denying or canceling your request.

It’s easy to see why the Apple Card* is so popular. Cardholders don’t pay an annual fee, foreign transaction fees or any late fees, but still have the chance to earn:

- 3 percent cash back on goods and services purchased directly from Apple

- 3 percent cash back on purchases with select merchants that let you pay with your Apple Card and Apple Pay

- 2 percent cash back on other purchases where you use your Apple Card with Apple Pay

- 1 percent back on all other purchases made with the physical card or online where Apple Pay is not accepted

And there’s more than one way to pay off an Apple Card, including online payments or recurring or one-time payments in your device’s Wallet app. If your device is missing or stolen, you can call an Apple Card specialist to avoid missing a payment.

However, when you dive into the Apple Card’s terms and conditions from Goldman Sachs, you’ll notice one interesting omission: The Apple Card doesn’t have a balance transfer APR or a balance transfer fee. That’s because this card doesn’t allow balance transfers to it at all.

But can you transfer your Apple Card balance to another card? The answer is complicated. Here’s what to know if you’re wondering how to pay off an Apple Card with a balance transfer but you keep running into roadblocks.

Can you transfer a balance from the Apple Card to another credit card?

Officially, no, the Apple Card does not appear to support balance transfers. Cardholder reports vary, but you can read real user experiences in places like the myFICO forum and Reddit. The consensus seems to be that it may be possible to transfer an Apple Card balance to another card, but results are inconsistent.

It appears to come down to what Apple considers “non-conforming payments.” Here’s what Apple says about payments it considers to be non-conforming in its cardholder agreement:

“We may reject any payments that do not comply with our payment instructions set forth in this Agreement or on your Monthly Statement (each a ‘Non-conforming Payment’) in our discretion. If we accept a Non-conforming Payment, crediting your Account for the payment may be delayed and may result in additional interest billed to your Account.”

Apple also says:

“We may accept any Non-conforming Payments, late payments, partial payments or payments with restrictive endorsements, without losing any of our rights, including our right to close your Account. We may deposit any payment you send us for less than the total outstanding balance of your Account that you mark ‘paid in full’ or with any similar language or otherwise seek to provide as full satisfaction of a disputed amount. If we do, this payment will not fully satisfy the disputed amount or otherwise affect our rights to payment in full.”

That said, Apple reserves the right not to accept any balance transfers from the Apple Card. It’s only required to accept a payment method that it has outlined, such as submitting online payments, paying through the Wallet app or by talking to an Apple specialist.

If Apple does accept a payment method that isn’t listed as an option to cardholders, there’s a possibility it could close the account. Even if a payment is sent and marked “paid in full,” it doesn’t mean Apple will accept the transfer. Rather, the issuer reserves the right to still pursue full repayment.

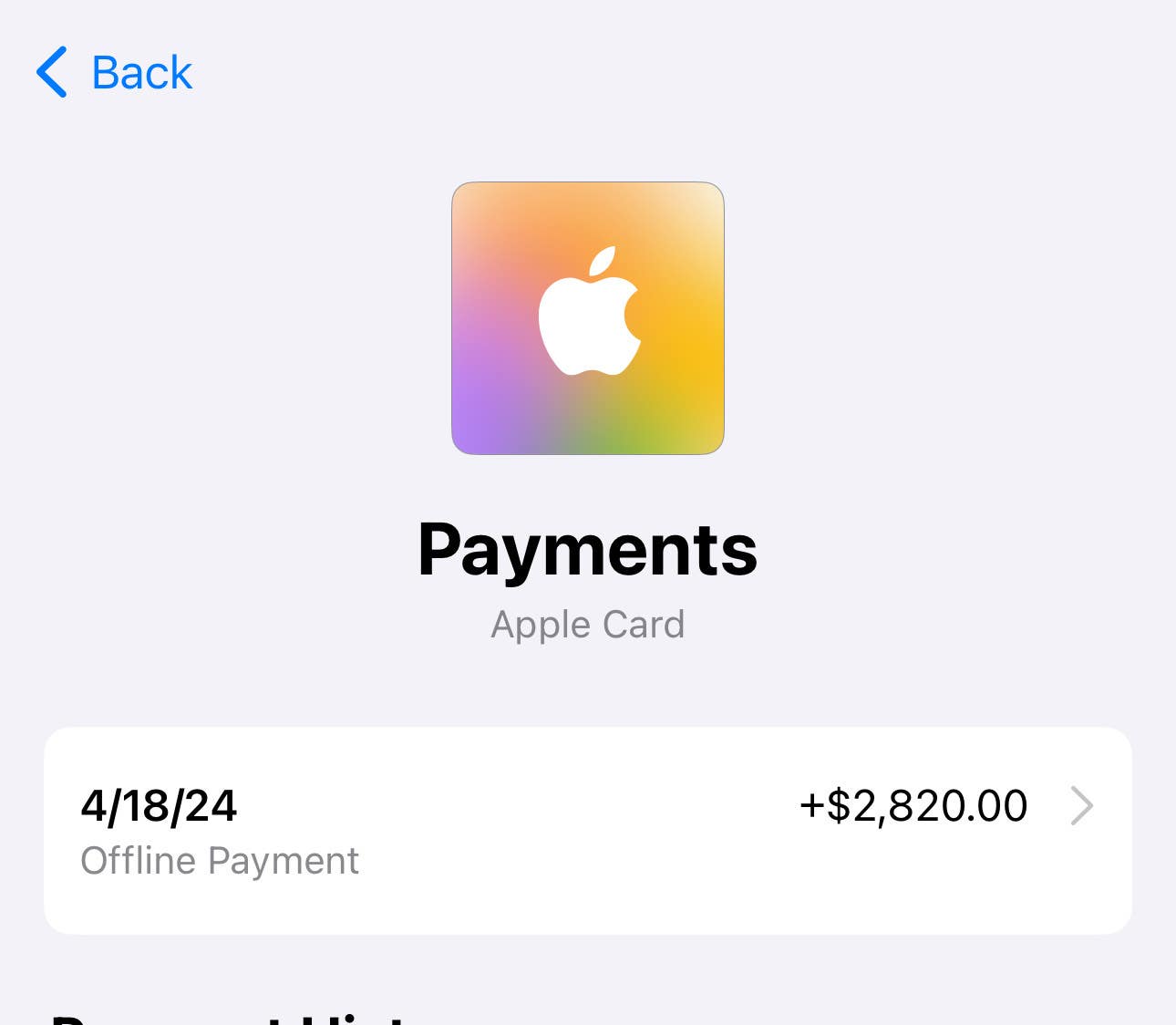

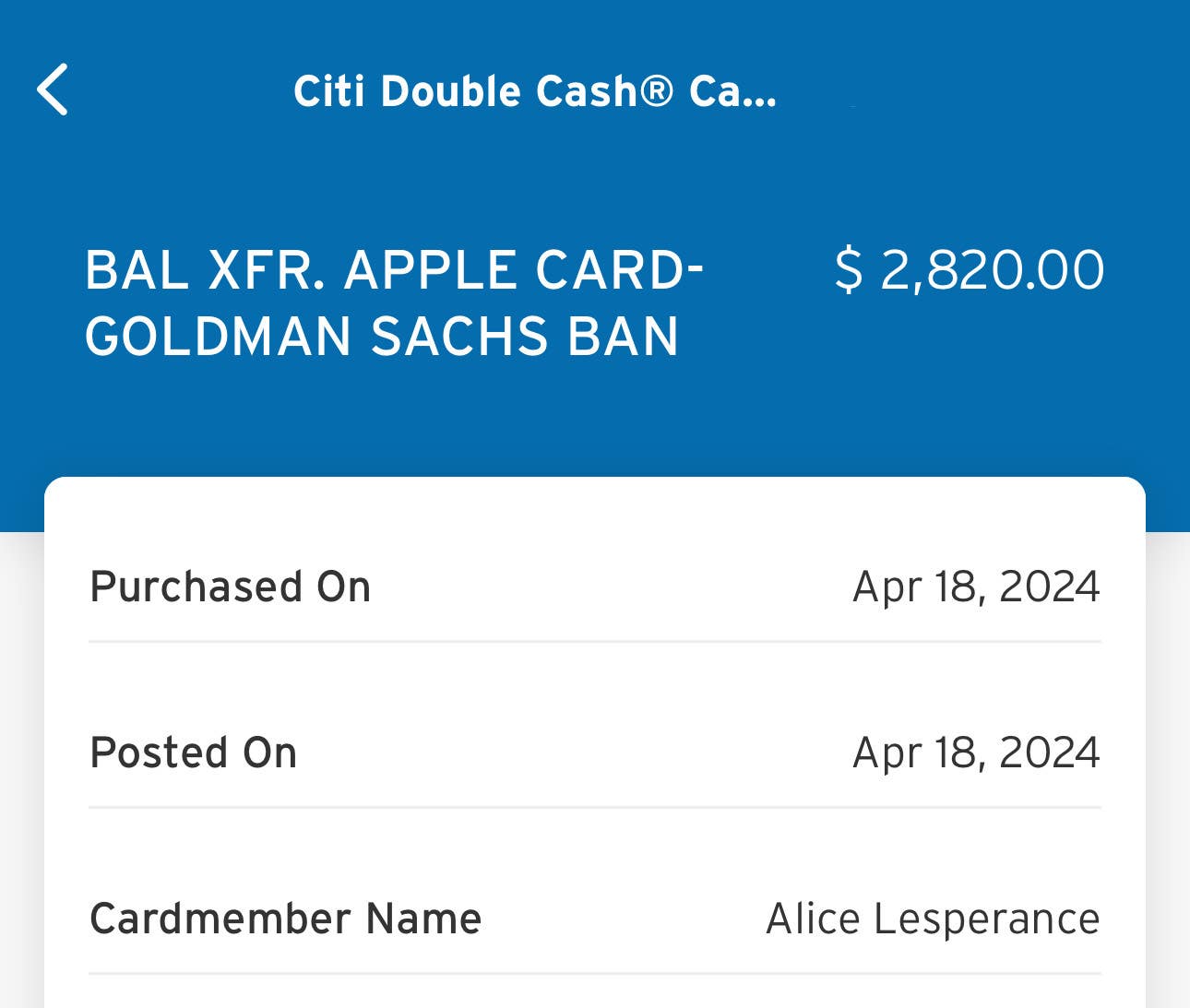

Alice Lesperance, a credit cards editor at Bankrate, successfully completed an Apple Card balance transfer to her Citi Double Cash® card but was not optimistic about it working out:

I did my research, so I knew that the Apple Card had a bad track record with balance transfers. You can try calling Goldman Sachs for help, but I had a hard time getting a clear answer. In the end, I just tried it on my own, and it worked. I entered my Apple Card account number, which is found in the Wallet App, and went through the normal balance transfer process with Citi in their app. To my surprise, it went through and I haven’t had any issues.

— Alice Lesperance, Editor at Bankrate

Below, you can see that the amount for the transfer was charged to Lesperance’s Citi card as a balance transfer but displays as an “Offline Payment” on Apple’s end in the Wallet App:

EXPAND