Over 50% of candidates fail their financial exams on their first attempt, underscoring the rigorous nature of these assessments. Such high stakes demand not just rote learning but a strategic approach to mastering complex financial concepts. This daunting reality propels professionals towards structured financial training programs.

Financial training has evolved significantly, blending traditional teaching methods with modern technology to enhance learning outcomes. The introduction of interactive modules and real-time practice tests has seen a 30% increase in pass rates. This combination of innovative tools and seasoned expertise provides the necessary foundation for success in financial exams.

The Importance of Preparing for Financial Exams

The Role of Financial Training in Success

Preparing for financial exams is crucial because of their challenging nature. The exams test a range of knowledge from basic principles to complex financial strategies. Without thorough preparation, the chances of passing these exams are slim.

Financial training programs provide essential structure to your study efforts. They offer a systematic approach to mastering the material. This structured learning is effective and ensures comprehensive coverage of all topics.

Strong, well-organized preparation boosts confidence. Confidence plays a significant role in exam performance. When you know you’ve prepared well, you’re more likely to succeed.

The Rigor of Financial Exams: Why Preparation Is Key

Financial exams are known for their rigor and high standards. The pressure to perform can be intense. This makes thorough preparation vital.

The complexity of these exams demands not just knowledge but also strategic thinking. You must be able to apply your knowledge in practical scenarios. This practical application is often where many candidates struggle.

- Better understanding of key concepts

- Ability to handle tricky questions

- Increased chances of passing on the first attempt

The Role of Financial Training in Success

Financial training is key to navigating complex exams and securing a successful outcome. The structure, discipline, and expertise provided by training programs make a substantial difference. Without this preparation, the road to success can be much steeper.

Benefits of Structured Learning

Structured learning ensures all important topics are covered in a systematic manner. This approach helps in retaining the information better. Consistency in study habits greatly boosts understanding and application of financial concepts.

Many training programs offer interactive sessions. These sessions make learning engaging and effective. Students can ask questions and clarify doubts immediately.

- Easier to grasp complex ideas

- Regular assessments to track progress

- Provides a clear study path

Access to Expert Guidance

Training programs are often led by industry experts with years of experience. They provide invaluable insights and tips. This expert guidance shapes your study approach and strategies.

Experts can explain complex material in simpler terms. This makes difficult topics more manageable. Their real-world examples offer practical understanding.

- Deep dives into crucial topics

- Strategies for handling exam pressure

- Insights into real-world financial scenarios

Improved Performance through Practice

Regular practice is an essential component of financial training. Most programs offer mock exams and practice tests. These simulate real exam conditions.

This practice helps in identifying weak areas. Students can then focus on improving these aspects. Simulated tests build familiarity with the exam format, reducing anxiety.

- Enhanced time management skills

- Better handling of tricky questions

- Increased confidence on exam day

The Rigor of Financial Exams: Why Preparation Is Key

Financial exams are known for their challenging nature and high standards. Achieving success requires more than just memorizing facts. Critical thinking and problem-solving skills are essential.

Preparation helps candidates understand complex topics more deeply. It builds the confidence needed to tackle difficult questions. Without it, even the brightest minds may struggle.

- Thorough understanding of key concepts

- Ability to apply knowledge practically

- Effective time management during exams

The pressure of financial exams can be intense. Prepared students handle this pressure better. They are equipped with strategies to manage stress and focus on answering questions effectively.

The Changing Landscape of Financial Training

The world of financial training is evolving rapidly. Traditional classroom-based learning is giving way to more flexible and accessible methods. Online courses and webinars are becoming increasingly popular.

Technology plays a huge role in this transformation. Virtual simulations and interactive platforms offer practical learning experiences. These tools make complex concepts easier to grasp.

- Real-time practice tests

- Virtual classrooms

- Interactive modules

Another significant change is the adaptation of training programs to fit individual needs. Personalized learning paths allow students to focus on areas where they need the most improvement. This targeted approach increases the effectiveness of the training.

The introduction of gamification in financial training is also noteworthy. Gamified elements like quizzes and leaderboards add a fun element to studying. They boost engagement and motivation.

- Competitive learning environment

- Instant feedback

- Enhanced retention of information

Traditional Methods Versus Modern Approaches in Financial Training

Traditional financial training often takes place in classrooms. These sessions are led by instructors who provide detailed explanations. This method has the advantage of immediate interaction.

However, classroom-based learning can be rigid. It follows a fixed schedule, which may not suit everyone. This lack of flexibility can be a drawback.

With modern approaches, training has become more accessible. Online courses and webinars allow students to learn at their own pace. This flexibility makes it easier for working professionals to balance their studies with their commitments.

- Self-paced learning modules

- Recorded sessions for later review

- Accessible from anywhere

Modern approaches also incorporate technology to enhance learning. Interactive tools such as virtual simulations provide hands-on experience. They make difficult concepts easier to understand and apply.

- Interactive quizzes

- Real-time feedback

- Engaging visual content

The blend of traditional and modern methods offers the best of both worlds. While traditional methods provide structure and discipline, modern approaches offer flexibility and accessibility. This combination caters to diverse learning needs and preferences.

The Rise of Technology in Financial Training

Technology has revolutionized financial training in recent years. With online platforms, anyone can access high-quality courses from anywhere. This increased accessibility has made financial education more inclusive.

Interactive tools are a significant part of this change. Virtual simulations allow users to practice real-world financial scenarios. These simulations enhance understanding and practical application.

- Real-time assessments

- Instant feedback

- Engaging, hands-on learning

Online forums and discussion groups also enhance learning. These platforms provide a space for students to ask questions and share knowledge. The community aspect encourages collaborative learning.

Additionally, data analytics play a crucial role. Tools that analyze student performance help tailor learning experiences. Personalized feedback ensures that each student gets the support they need.

- Customized study plans

- Identifying weak areas

- Tracking progress effectively

Strategies for Effective Financial Exam Preparation

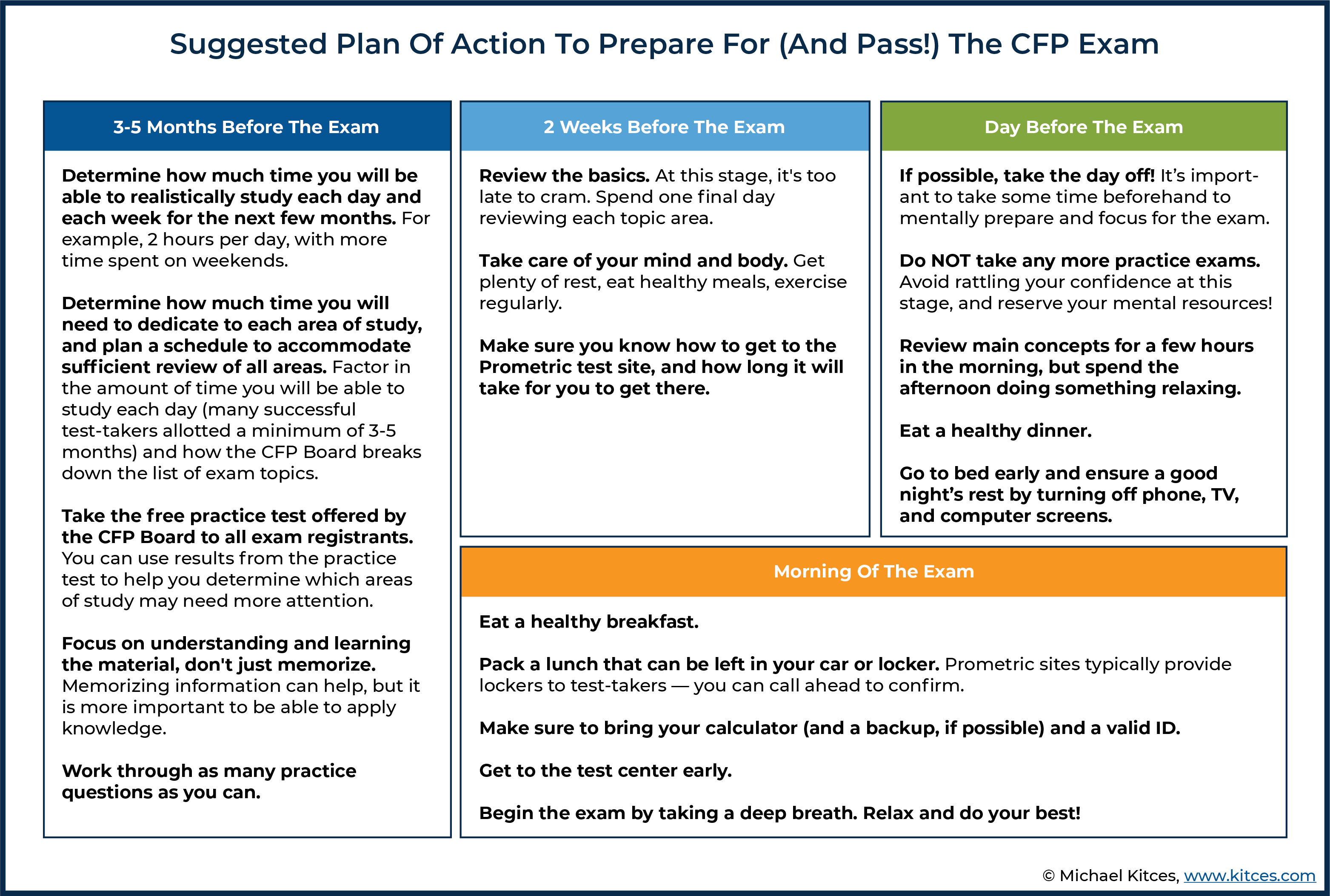

Effective preparation starts with a well-structured study plan. Breaking down the material into manageable chunks makes studying less overwhelming. Consistency is key; regular, focused study sessions are more productive than cramming.

Utilize practice tests to gauge your understanding. These mimic the conditions of the actual exam and help identify weak areas. Adjust your study plan based on these results for targeted improvement.

- Create a realistic timetable

- Include short breaks to avoid burnout

- Mix older and newer topics in each session

Engage in active learning techniques such as summarizing notes and teaching others. This reinforces knowledge and ensures better retention. Group studies can also be beneficial if managed effectively.

A balanced lifestyle contributes greatly to exam success. Adequate sleep, exercise, and a healthy diet keep your mind sharp. Stress management techniques, like mindfulness or meditation, can help maintain focus.

- Sufficient rest each night

- Regular physical activity

- Mental relaxation practices

Harnessing the Benefits of Structured Study Plans

Structured study plans are essential for effective financial exam preparation. They help organize your study time and ensure that all topics are covered. Consistency is crucial; spreading study sessions over time prevents cramming.

A clear schedule reduces anxiety by providing a roadmap. Knowing what to study and when can make the process less overwhelming. It keeps you focused and motivated.

- Create weekly goals

- Include time for revision

- Set aside time for breaks

Structured plans allow for better time management. They help allocate time to both weak and strong areas. Adjusting your plan based on progress ensures that you stay on track.

Using tools like calendars or digital apps can enhance your study plan. These tools send reminders and track your study hours. This helps in maintaining consistency and keeping up with the schedule.

- Digital calendars

- Task management apps

- Study planners

Overall, a structured study plan makes preparation less stressful and more efficient. It provides a clear path to follow, ensuring comprehensive coverage of all exam topics. This method boosts confidence and improves your chances of success.

Leveraging Interactive Modules and Practice Tests

Interactive modules make learning more engaging by breaking down complex topics. These modules often include videos, quizzes, and real-time feedback. This variety keeps students interested and motivated.

Practice tests are an excellent way to prepare for financial exams. They simulate the actual test environment, helping students manage time effectively. Regular practice tests also highlight areas needing improvement.

- Identify weak points

- Enhance time management

- Reduce exam anxiety

Interactive modules offer hands-on experience, which is crucial in financial training. These tools often use real-world scenarios to teach concepts. Applying knowledge in practical settings makes it easier to understand and retain information.

The combination of interactive modules and practice tests provides a comprehensive learning experience. Modules teach the theory, while practice tests evaluate understanding. This dual approach ensures thorough preparation.

Using these tools, students can track their progress over time. Analytics and feedback from these tools help adjust study plans. Customized learning paths then focus on areas that need more attention.

- Track performance

- Adjust study plans

- Focus on improvement

The Impact of Financial Training on Exam Performance

Financial training significantly boosts exam performance. By providing a structured approach, it ensures that all critical topics are covered. Well-prepared students find it easier to navigate complex questions.

Training programs often include practice exams. These help students get used to the exam format and timing. Familiarity with the exam layout reduces anxiety.

- Improved time management

- Comfort with exam format

- Reduced stress levels

Interactive modules engage students more effectively than traditional methods. Real-world case studies make learning relevant and practical. This not only aids retention but also enhances problem-solving skills.

Expert guidance from experienced trainers adds great value. Trainers can provide insights that are not available in textbooks. This personalized support addresses individual weaknesses.

Overall, financial training offers a holistic approach to exam preparation. It combines theory with practical applications, making learning more comprehensive. The result is improved confidence and better exam scores.

- Comprehensive learning

- Enhanced confidence

- Higher exam scores

Statistical Evidence: Training and Pass Rates Correlation

Many studies show a strong link between financial training and higher pass rates. Students who engage in structured training programs are more likely to pass their exams. This is true for both beginners and experienced professionals.

One study revealed that students who attend training courses have a 40% higher pass rate. The structured environment provides them with the tools they need. These tools include mock exams, study guides, and expert feedback.

- 40% higher pass rate

- Access to mock exams

- Expert feedback and guidance

Another research showed a similar trend with online courses. Online learners often outperform those who study alone. This could be due to the interactive nature of online modules.

Tracking student progress through analytics also supports this correlation. Data shows that consistent training leads to better scores. Thus, statistical evidence strongly supports the importance of financial training for passing exams.

| Study Type | Pass Rate Increase |

|---|---|

| In-person Training | 40% |

| Online Courses | 35% |

| Self-study | 20% |

How an In-depth Understanding of Financial Concepts Influences Results

An in-depth understanding of financial concepts significantly boosts exam performance. Knowledge is not just about memorizing facts. It involves grasping the underlying principles and being able to apply them.

Comprehensive knowledge of financial concepts allows for better analysis. This means you can solve complex problems more efficiently. It also helps to spot tricky questions and answer them correctly.

- Enhanced analytical skills

- Efficient problem-solving

- Ability to handle tricky questions

In-depth understanding builds confidence. If you truly understand the concepts, you are less likely to panic. You can approach each question methodically.

Real-world examples make theoretical concepts clearer. Applying what you learn to real situations helps cement your knowledge. This practical approach improves retention and understanding.

| Benefit | Impact |

|---|---|

| Analytical Skills | Better problem-solving |

| Confidence | Less exam anxiety |

| Practical Application | Higher retention |

In-depth knowledge also aids in time management during exams. You can quickly identify which questions to tackle first. This ensures you complete the exam in the allocated time.

- Improved time management

- Prioritizing questions

- Completing exams on time

Frequently Asked Questions

Financial training is essential for success in financial exams. Here are some of the most common questions experts have about preparing for these rigorous assessments.

1. How does financial training improve exam performance?

Financial training provides a structured study plan that covers all critical topics comprehensively. This approach ensures that you don’t miss any important areas, which is crucial for doing well on exams.

Additionally, training programs often include practice tests and expert feedback. These elements help you identify your weaknesses and focus on improving them, making you more confident and better prepared.

2. What types of resources are offered in financial training programs?

Most financial training programs offer a variety of resources including online modules and live webinars. Interactive tools like quizzes and virtual simulations allow for hands-on learning.

Furthermore, many programs provide access to expert instructors who can offer personalized guidance. This combination of resources helps tailor the learning experience to meet individual needs.

3. Is it necessary to use practice tests during preparation?

Practice tests are incredibly useful because they mimic the format and conditions of the actual exam. They help you get used to time management and question types you’ll encounter.

You can also track your progress through these tests, which allows you to focus on weak areas. Improving these gaps increases your overall readiness for the exam day.

4. Can technology enhance traditional financial training methods?

Yes, technology significantly enhances traditional methods by adding flexibility and interactivity. Online courses allow students to learn at their own pace, making education more accessible.

An added benefit is real-time feedback from digital quizzes and simulations, which helps reinforce learning immediately. These modern tools make studying more engaging and effective.

5. What makes personalized study plans effective?

A personalized study plan focuses on individual strengths and weaknesses, allowing for targeted improvement. This method ensures that time spent studying is efficient and productive.

The flexibility of a tailored plan also reduces stress by breaking down material into manageable segments. This approach makes preparation less overwhelming, leading to better retention and higher exam scores.

Conclusion

Financial training is indispensable for preparing for exams in this rigorous field. It offers a structured, comprehensive approach to learning that is supported by both modern tools and expert guidance. Such training not only aids in knowledge retention but also enhances practical application skills.

By leveraging interactive modules, personalized study plans, and practice tests, candidates can significantly improve their chances of success. The combination of these elements ensures effective preparation, ultimately leading to higher pass rates and greater confidence in tackling complex financial exams.