Consider this: over 60% of Americans live paycheck to paycheck, highlighting the critical role of cashflow management in personal finance. A consistent cashflow can make the difference between financial security and economic strain. For experts analyzing these trends, it’s clear that managing cashflow is not just a routine task but a cornerstone of fiscal health.

Historically, the concept of cashflow income has been vital since the advent of modern banking systems. A compelling statistic reveals that well-managed cashflow can reduce financial stress by up to 75%, according to recent studies. Ensuring steady cash inflows allows individuals to invest strategically, save efficiently, and plan for long-term financial goals.

Defining Cashflow Income in Personal Finance

The Concept of Cashflow Income

Cashflow income refers to the money flowing in and out of your wallet. It includes your salary, business earnings, and other regular sources of income. Effective cashflow management ensures you can meet your financial obligations on time.

Think of cashflow as the lifeblood of your finances. Without it, you can’t pay bills or save for the future. It’s crucial to track your cashflow closely.

Many individuals struggle with negative cashflow, where expenses exceed income. This can lead to debt and financial stress. On the other hand, positive cashflow provides stability and growth opportunities.

Differentiating Between Cashflow and Income

Income is the total money you earn, while cashflow focuses on the timing of these inflows and outflows. Simply put, income is the source, and cashflow is how it moves. Understanding this distinction helps in better financial planning.

Consider a business example: A company may have high income but poor cashflow due to pending payments. Personal finances work similarly; you need consistent cash inflows to sustain your lifestyle.

By managing both income and cashflow effectively, you can avoid financial pitfalls. Regularly reviewing your finances is essential. Use budgeting tools to stay on top of your game.

The Concept of Cashflow Income

Cashflow income is essential as it represents how money moves in and out of your personal finance system. Understanding this movement helps you manage expenses and plan for savings. Effective cashflow management can lead to financial stability and growth.

What is Cashflow Income?

Cashflow income refers to the net amount of cash being transferred in and out of your accounts. This includes your regular salary, side gigs, or even rental income. Keeping track of your cashflow helps you understand your financial health better.

Without a good grasp of cashflow, even high earners can face financial problems. It’s not just about how much you earn, but also how well you manage it. Maximizing your cashflow ensures you can cover your expenses and save for future goals.

Many people mix up income and cashflow. Income is what you earn, while cashflow is how that money flows in and out. Understanding the difference is crucial for effective financial planning.

The Importance of Monitoring Cashflow

Monitoring cashflow helps you identify financial patterns and predict future financial needs. For instance, you can see if your expenses spike at certain times of the year. This allows for better planning and budgeting.

Using tools like apps or spreadsheets can make tracking easier. These tools can categorize your spending and alert you to unusual activities. Regular monitoring keeps your finances on track.

Inconsistent cashflow can lead to stress and make it hard to meet financial obligations. By tracking it, you can ensure you always have enough money for essentials. This reduces the risk of unexpected financial shortfalls.

Improving Cashflow through Budgeting

Creating a budget is a powerful tool for managing cashflow. A budget helps you plan your spending based on your income. Proper budgeting ensures you have enough for both necessities and savings.

Start by listing all your income sources and regular expenses. Then, categorize your expenses to see where your money goes. This makes it easier to adjust spending habits.

Once you have a budget, stick to it for a few months to see its impact on your cashflow. Regularly review and adjust it as needed. This ongoing process helps improve your overall financial health.

Differentiating between Cashflow and Income

Cashflow and income are terms often used interchangeably, but they have distinct meanings. Income refers to the total amount of money you earn from various sources. Cashflow, on the other hand, is about the timing of incoming and outgoing money.

Think of income as the big picture of your earnings. It includes your salary, investments, and any other earnings. Cashflow reflects the health of your day-to-day finances, showing your ability to cover expenses when they arise.

For instance, you might have a substantial yearly income but poor cashflow if you face seasonal expenses. This can cause financial strain despite high earnings. Monitoring cashflow helps identify these patterns and prepare accordingly.

Here’s a simple comparison of the key differences:

| Aspect | Income | Cashflow |

|---|---|---|

| Definition | Total earnings | Timing of money movement |

| Focus | Overall wealth | Day-to-day finances |

| Importance | Long-term planning | Short-term stability |

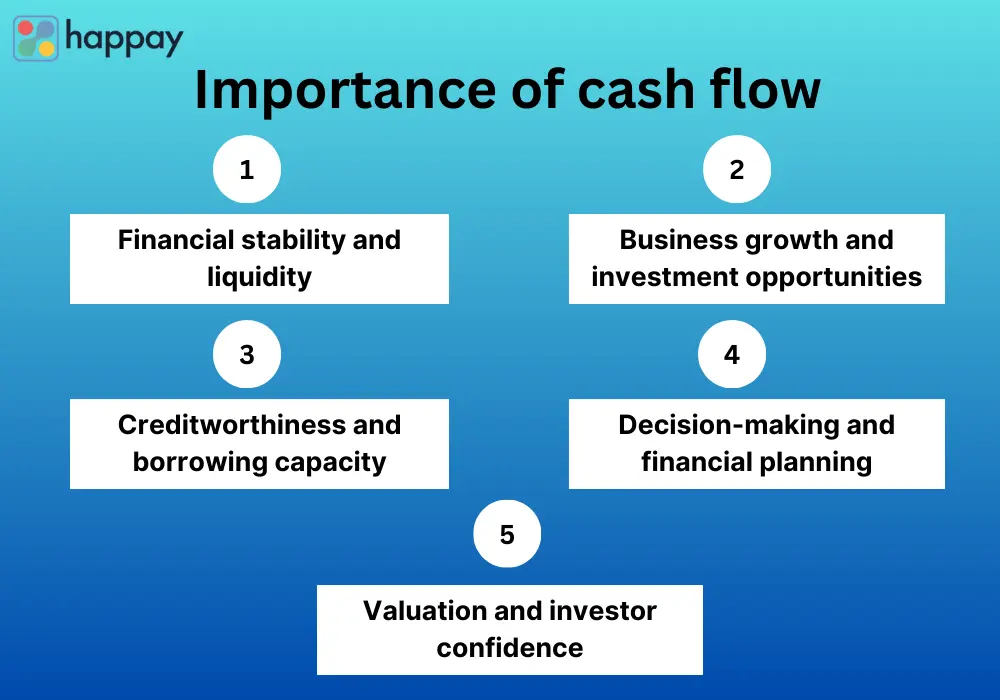

The Role of Cashflow Income in Personal Finance

Cashflow income plays a crucial role in maintaining financial stability. It not only helps cover daily expenses but also ensures you can manage unexpected costs. Good cashflow management leads to better financial health.

One key benefit of positive cashflow is the ability to save for future goals. Whether it’s for education, vacations, or retirement, saving becomes easier when your cashflow is stable. Consistent savings allow for peace of mind and financial security.

Another advantage is the opportunity to invest. With a positive cashflow, you can allocate funds toward stocks, real estate, or other investments. These investments can grow over time and provide additional income streams.

Cashflow also affects your ability to handle debt. When you have a steady cashflow, you can make regular payments on loans or credit cards. This lowers interest costs and helps improve your credit score.

Here’s a quick look at how proper cashflow management can benefit you:

- Ensures timely bill payments

- Helps build an emergency fund

- Allows for strategic investments

- Reduces financial stress

Effective cashflow management involves monitoring inflows and outflows regularly. Use budgeting tools and apps to track your finances. Regular reviews help you spot issues early and make adjustments as needed.

Supporting Regular Expenses

Managing your cashflow is essential to cover regular expenses. These expenses include rent, utility bills, groceries, and other household costs. A positive cashflow ensures you can pay these expenses on time.

Ensuring that your cashflow matches your expense schedule is key. For instance, if you get paid every two weeks, plan your bills around that timing. This helps you avoid late fees and maintains peace of mind.

Tracking daily expenses is also crucial. Small, unplanned expenses can add up quickly. Using budgeting apps can help you keep an eye on these costs and stay within your budget.

Here are some common regular expenses:

- Rent or mortgage payments

- Utility bills (electricity, water, gas)

- Groceries and household items

- Transportation (fuel, public transit)

- Insurance premiums

By effectively managing these expenses, you can ensure financial stability. Predictable cashflow helps in planning for the future and achieving financial goals. Regular reviews of expenses and income can prevent financial shortfalls.

Funding Investments and Savings

A positive cashflow enables you to fund your investments. You can allocate money toward stocks, bonds, and other financial instruments. Strategic investments can provide returns and grow your wealth over time.

Savings are another crucial aspect of personal finance. Setting aside part of your cashflow for savings helps build an emergency fund. This fund can cover unexpected expenses and reduce financial stress.

Automating your savings can make the process easier. You set up automatic transfers from your checking account to a savings or investment account. This method ensures you consistently save without the temptation to spend that money.

Here are some ways to allocate your positive cashflow:

- Regular contributions to a retirement fund

- Investing in a diversified portfolio

- Building an emergency fund

- Saving for significant future expenses (education, home purchase)

Monitoring the performance of your investments is vital. Regularly check how your money grows and make adjustments as necessary. Reviewing your strategies ensures that your investments align with your financial goals.

Effective management of cashflow and savings leads to financial security. Consistent contributions to savings and investments help achieve long-term goals. Regular reviews and adjustments maximize your financial potential.

The Effects of Positive and Negative Cashflow

Positive cashflow occurs when your income exceeds your expenses. This surplus allows you to save, invest, and plan for the future. Having a positive cashflow provides financial security and peace of mind.

Negative cashflow means your expenses are greater than your income. This can lead to accumulating debt and financial stress. Over time, consistently negative cashflow can damage your credit score.

The benefits of positive cashflow are numerous. You can build an emergency fund, invest in opportunities, and even enjoy some luxuries. This financial stability makes it easier to achieve long-term goals.

Here’s how different cashflow situations compare:

| Effect | Positive Cashflow | Negative Cashflow | |||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Savings Ability | Easier to save money regularly | Difficult to save; may use savings to cover costs | |||||||||||||||||||||||||||||||||||||

| Investment Opportunities | Able to invest extra funds for growth | No extra funds available for investment | |||||||||||||||||||||||||||||||||||||

| Stress Levels | Lower financial stress due to stable finances | Higher stress due to constant financial pressure |

| Factor | Impact on Cashflow |

|---|---|

| Savings | Provides a safety net and reduces financial stress |

| Investments | Can generate extra income and grow wealth |

Automating savings can make the process easier. Set up automatic transfers from your checking account to your savings or investment accounts. This ensures consistent contributions without effort.

Here are some benefits of healthy savings and investments:

- Emergency funds protect against unexpected costs

- Investments can grow wealth over time

- Diversified income streams provide financial security

- Automated savings simplify financial planning

Consistent savings and smart investments improve cashflow and financial health. Regularly review your financial goals to ensure you’re on track. Making informed decisions leads to a more secure future.

Overcoming Common Cashflow Challenges

Managing cashflow can be tricky, but it’s essential for financial stability. One common challenge is dealing with irregular income. Freelancers and seasonal workers often face this issue.

To tackle irregular income, it’s crucial to budget cautiously. Save a significant portion during high-earning periods to cover lean times. This strategy helps you maintain a steady cashflow year-round.

Unexpected expenses can also disrupt cashflow. Emergencies like car repairs or medical bills can strain your finances. Building an emergency fund can help you manage these sudden costs without stress.

Here are some tips to handle cashflow challenges:

- Track all income and expenses diligently

- Create and stick to a budget

- Save extra funds during high-earning periods

- Build and maintain an emergency fund

Another challenge is managing debt. High-interest loans and credit card balances can drain your cashflow. Focus on paying off high-interest debt first to free up funds for other expenses.

Here’s a look at prioritizing debt repayments:

| Action | Impact on Cashflow |

|---|---|

| Pay off high-interest debt | Reduces monthly interest payments |

| Consolidate loans | Creates a single, manageable payment |

Overcoming cashflow challenges requires planning and discipline. Regularly review your financial habits and make adjustments as needed. Staying proactive helps you maintain a healthy cashflow and achieve financial goals.

Cashflow Management for Irregular Incomes

Managing cashflow when you have irregular income can be challenging. Freelancers, contractors, and gig workers often face this issue. Planning and budgeting become crucial in such scenarios.

Start by tracking all your income and expenses carefully. Make a list of your monthly necessities like rent, utilities, and groceries. This helps you understand how much you need to earn each month.

Here’s a simple monthly budget table:

| Category | Monthly Budget |

|---|---|

| Rent | $800 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $100 |

During high-earning periods, save a significant portion of your income. Building up an emergency fund is vital. This fund will support you during months when your earnings are low.

Consider setting up automatic transfers to a savings account. This ensures that you save money without thinking about it. Savings help smooth out the ups and downs of irregular income.

Here are some key tips for managing irregular income:

- Track income and expenses diligently

- Create a monthly budget

- Save during high-earning periods

- Build an emergency fund

- Set up automatic savings transfers

By following these strategies, you can achieve financial stability despite having irregular income. Regularly review and adjust your budget as needed. Staying organized and proactive helps you maintain healthy cashflow.

Addressing Unexpected Expenses

Unexpected expenses can throw off your budget. These can include car repairs, medical bills, or emergency home fixes. Planning ahead makes handling these surprises easier.

Building an emergency fund is the first step. Aim to save 3 to 6 months’ worth of living expenses. This fund acts as a financial cushion when surprises occur.

Here’s a look at how to allocate your emergency fund:

| Expense | Monthly Cost | Amount to Save (6 months) |

|---|---|---|

| Rent | $800 | $4800 |

| Utilities | $150 | $900 |

| Groceries | $300 | $1800 |

| Transportation | $100 | $600 |

Another strategy is to adjust your budget temporarily. Cut down on non-essential spending if unexpected costs arise. This helps divert funds to cover immediate needs without going into debt.

Consider having a credit card or a line of credit for emergencies. Use this option only if you can pay it off quickly. Responsible use of credit minimizes interest costs and avoids long-term debt.

Here are some tips for handling unexpected expenses:

- Build an emergency fund

- Adjust budget to prioritize urgent costs

- Use credit responsibly only when needed

- Review and replenish emergency fund regularly

By planning and saving, you can handle unexpected expenses smoothly. Regularly review your emergency fund and make adjustments as needed. Being prepared ensures financial security even when life throws you a curveball.

Frequently Asked Questions

Understanding cashflow income is vital for maintaining healthy personal finances. Here are some common questions and answers to help you grasp its importance better.

1. What is the difference between cashflow and net income?

Cashflow refers to the actual money coming in and going out of your accounts, focusing on liquidity. Net income, however, represents total profits after all expenses have been deducted from revenues, highlighting profitability.

This distinction helps in financial planning as good cashflow ensures you can meet short-term obligations. Meanwhile, net income reflects long-term financial success and sustainability.

2. How does positive cashflow contribute to financial health?

Positive cashflow ensures you have extra money beyond basic expenses, allowing you to save and invest. This surplus creates a buffer against unexpected costs, reducing stress and enhancing financial stability.

It also facilitates long-term goals like retirement planning or purchasing a home. Consistently positive cashflow strengthens your overall financial position by providing flexibility and security.

3. What are common ways to improve cashflow income?

Improving cashflow can be achieved by budgeting carefully, cutting unnecessary expenses, and boosting income through side jobs or freelance work. Using apps to track spending helps identify areas for improvement.

Additionally, investing wisely in assets that generate regular returns increases your inflows over time. Regular reviews ensure you’re on track while adjusting strategies as needed enhances effectiveness.

4. Why is it important to monitor cash inflows and outflows regularly?

Regularly monitoring cash inflows and outflows helps you understand spending patterns and manage your budget better. It highlights areas where adjustments are needed to maintain financial balance.

This practice reduces the risk of running into shortages that could lead to debt or missed payments. Continuous tracking also supports more informed decision-making regarding savings and investments.

5. How does managing debt affect cashflow management?

Managing debt effectively frees up more funds for other purposes, improving overall cashflow health. Prioritizing high-interest debts first reduces interest payments over time.

This approach offers additional money for saving or investing once debts are cleared or minimized. Effective debt management fosters better financial stability by ensuring a steady flow of available funds.

Conclusion

Understanding cashflow income is essential for maintaining strong personal finances. It allows you to meet regular expenses, save for future goals, and invest wisely. Without proper cashflow management, even a high income can lead to financial stress.

Effective strategies, such as budgeting and building an emergency fund, play a crucial role. Regularly monitoring your cashflow ensures you can adjust and stay on track. These practices together foster long-term financial stability and growth.